Zum Rails

B2B Fintech — Enabling faster lending decisions for B2B customers

Striving for parity

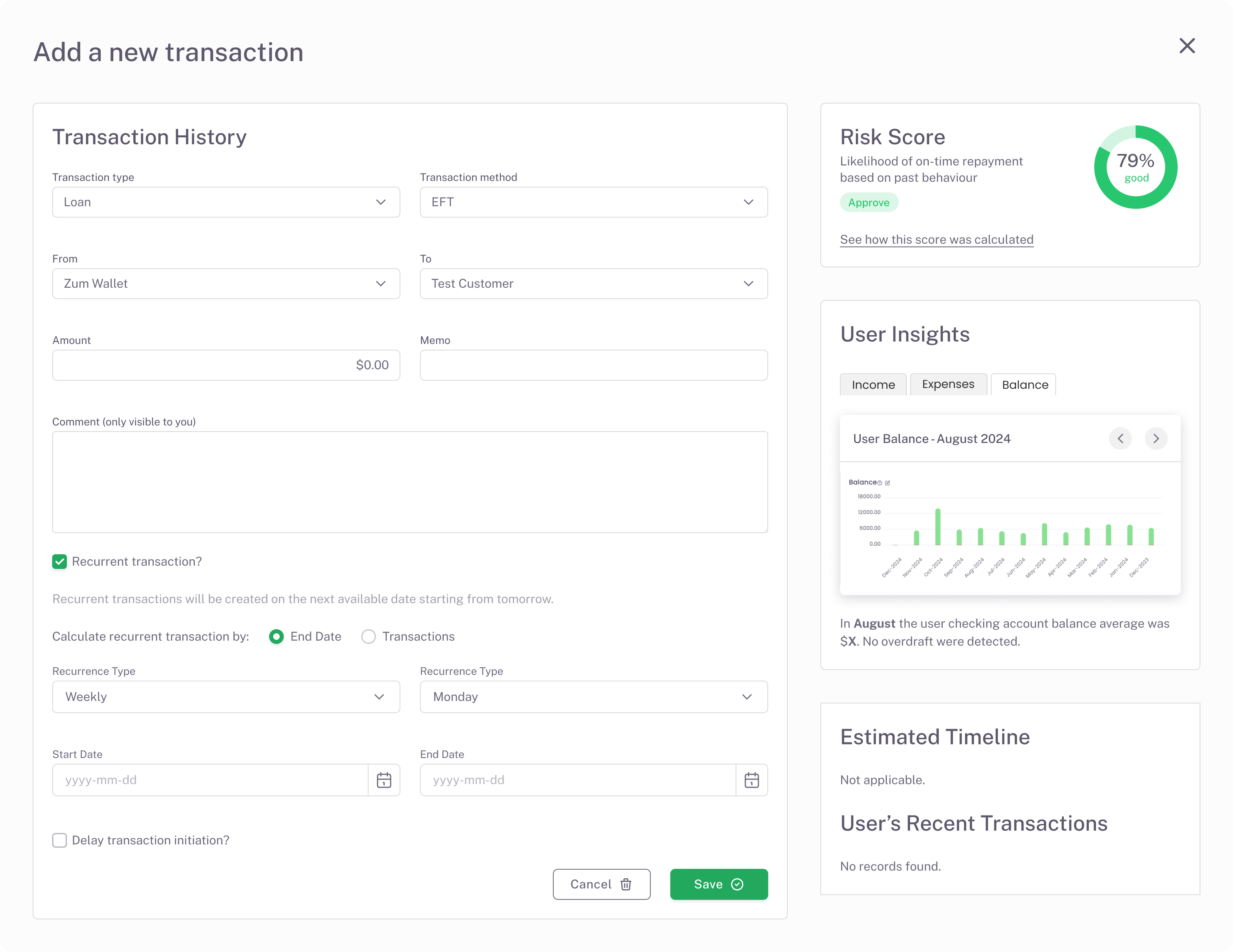

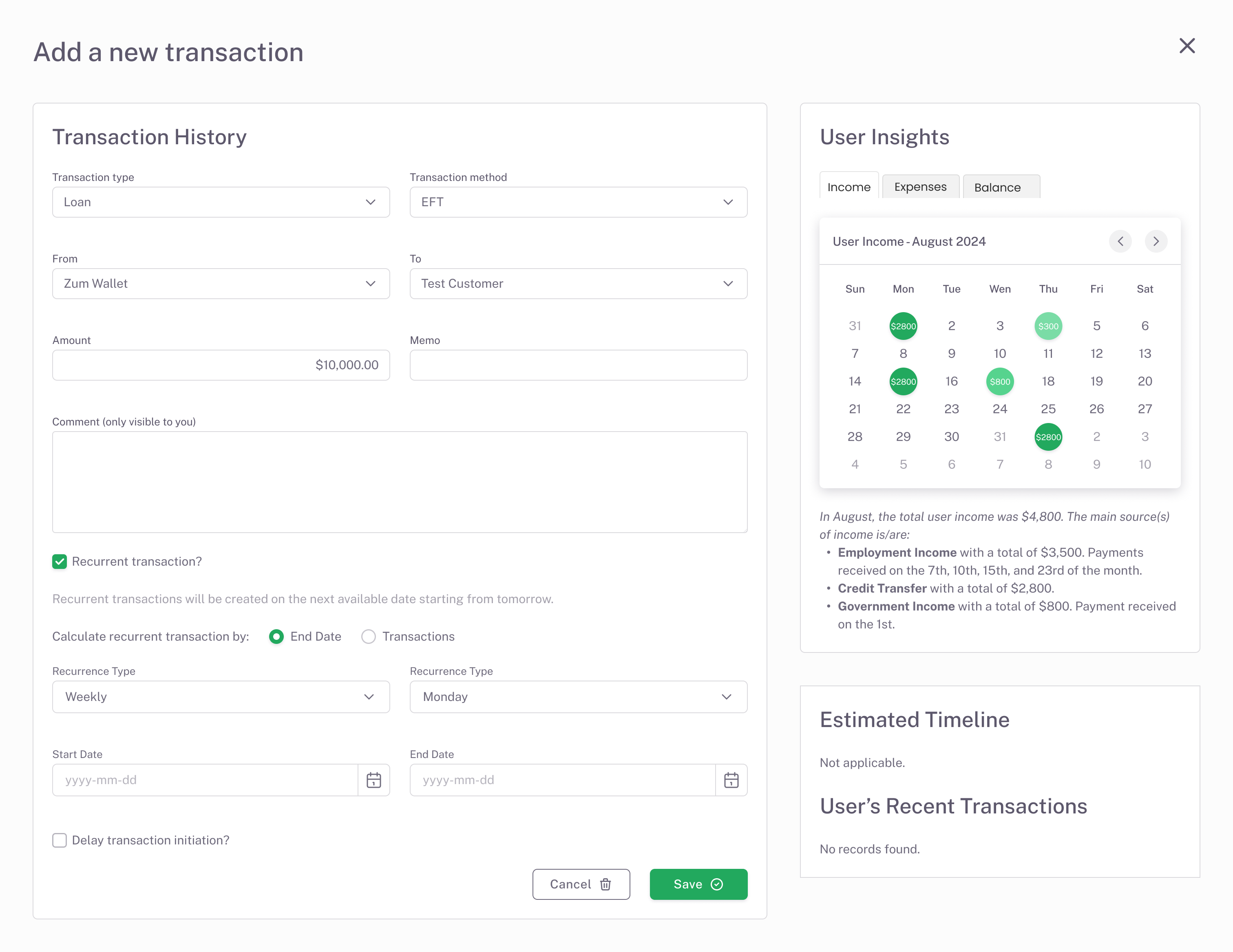

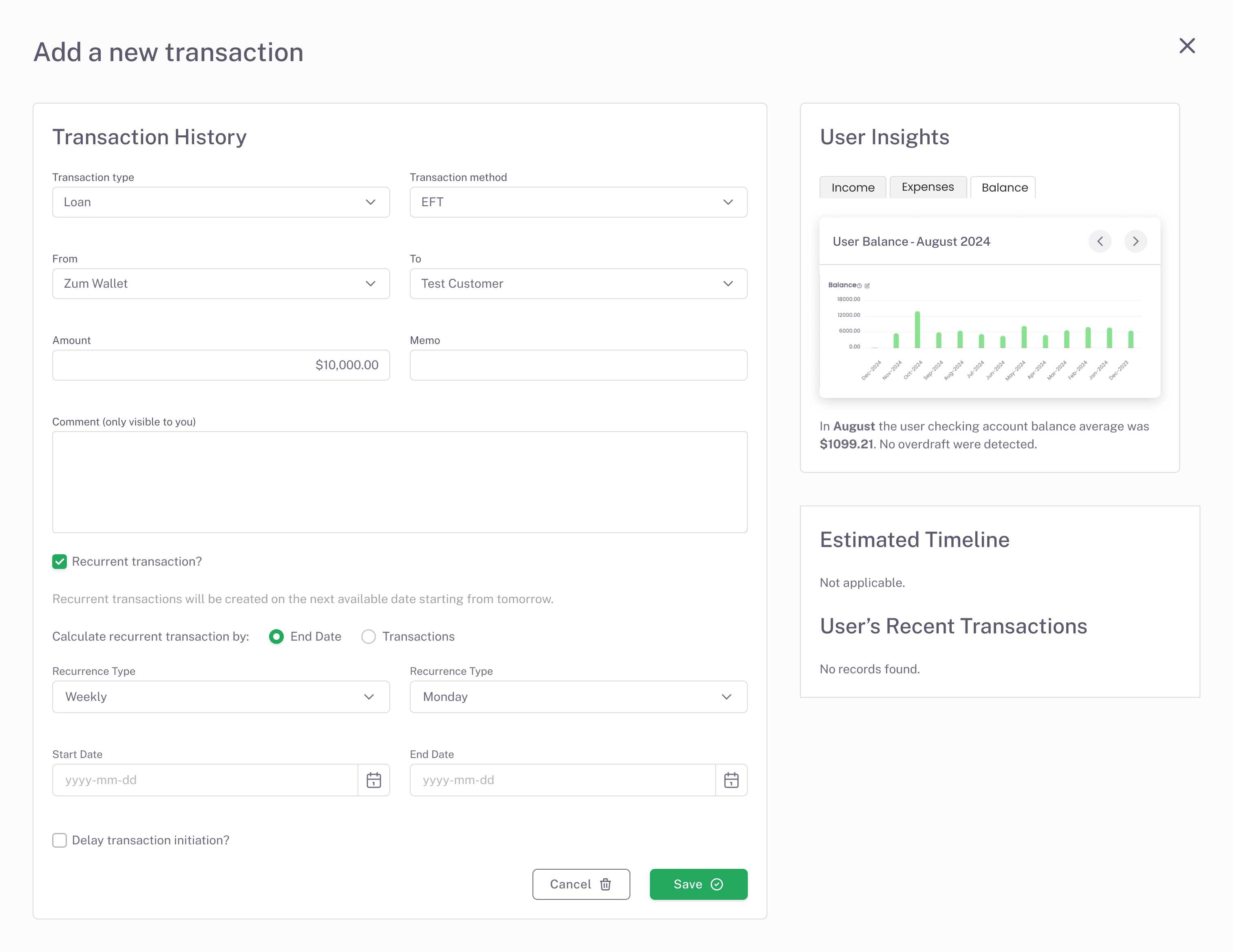

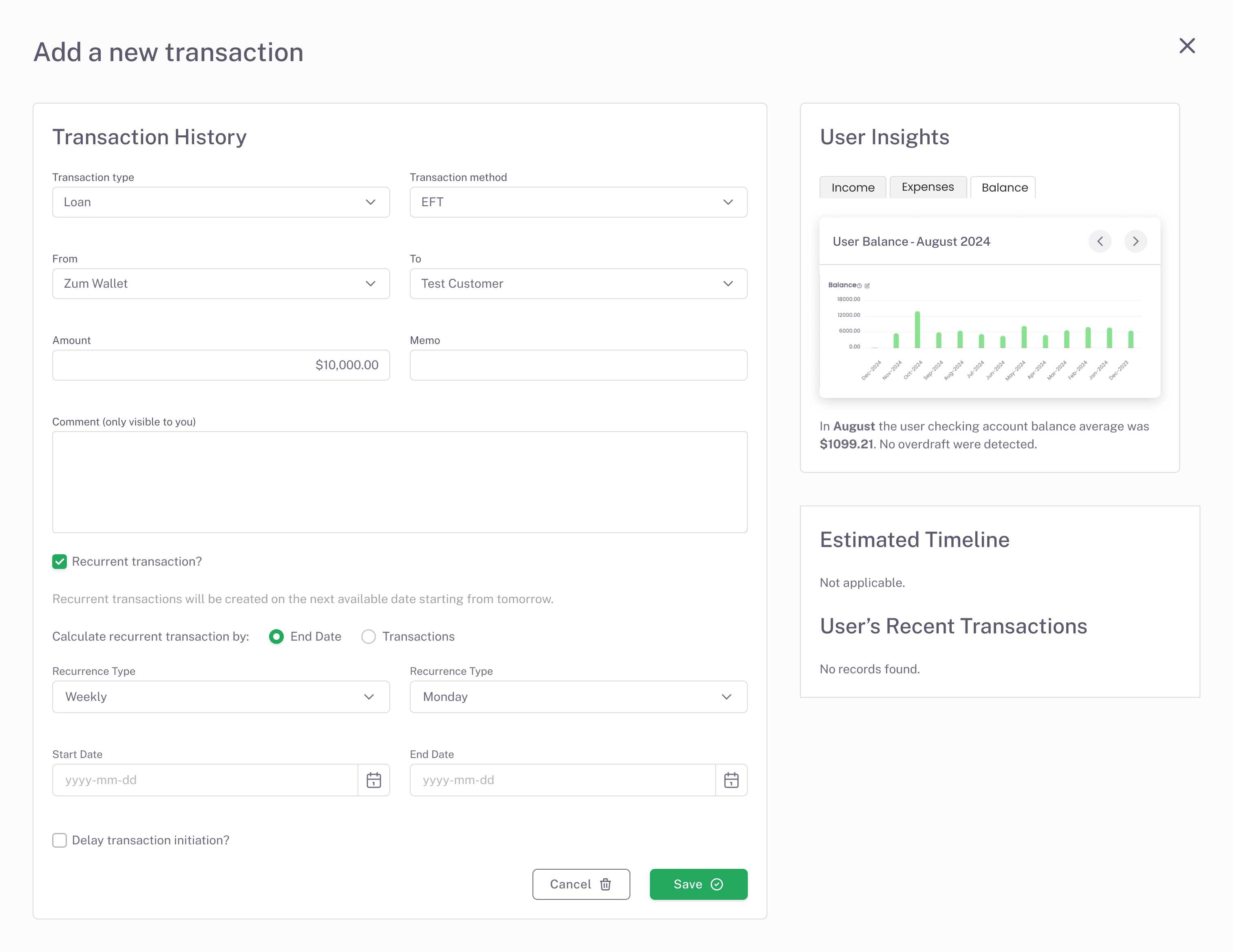

Mapping major expenses, deposits, and account balances per month

Competitor tools were so valuable that customers used them for insights, then returned to us for payments. Rather than reinvent the wheel, we chose to start by matching these proven features. They offered clear, trusted value: highlighting key transactions and trends that directly supported faster lending decisions.

Faster lending decisions

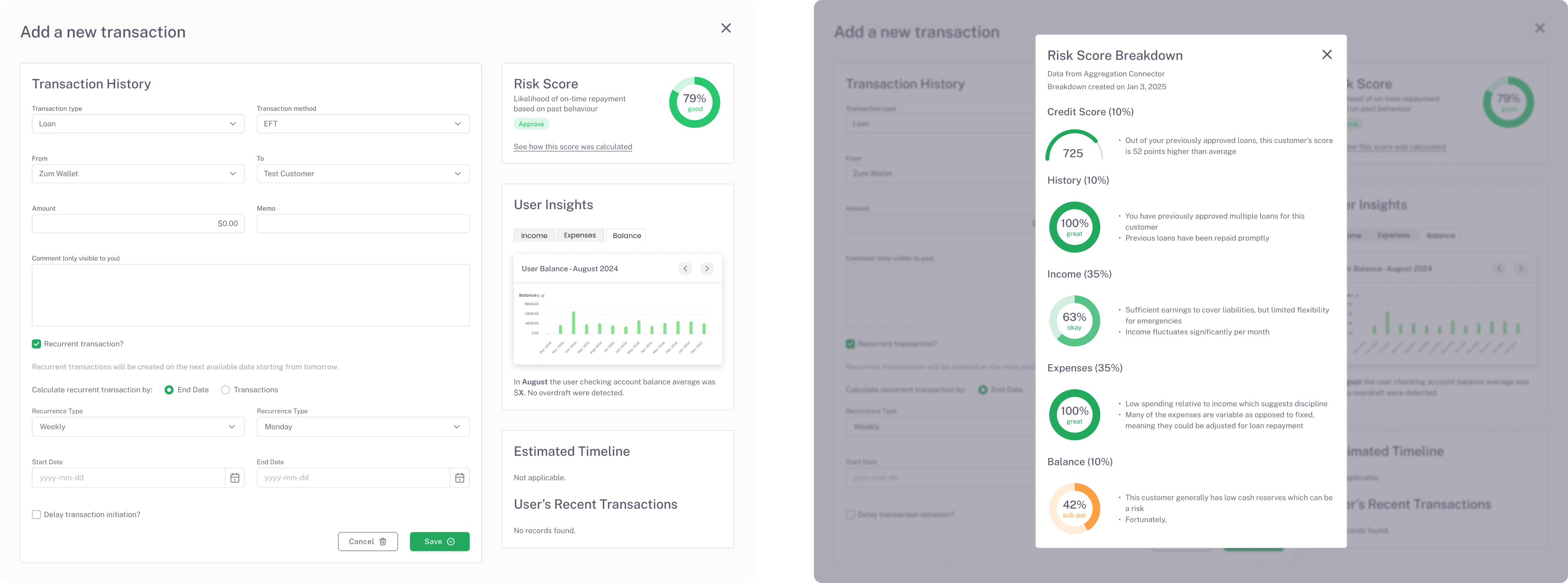

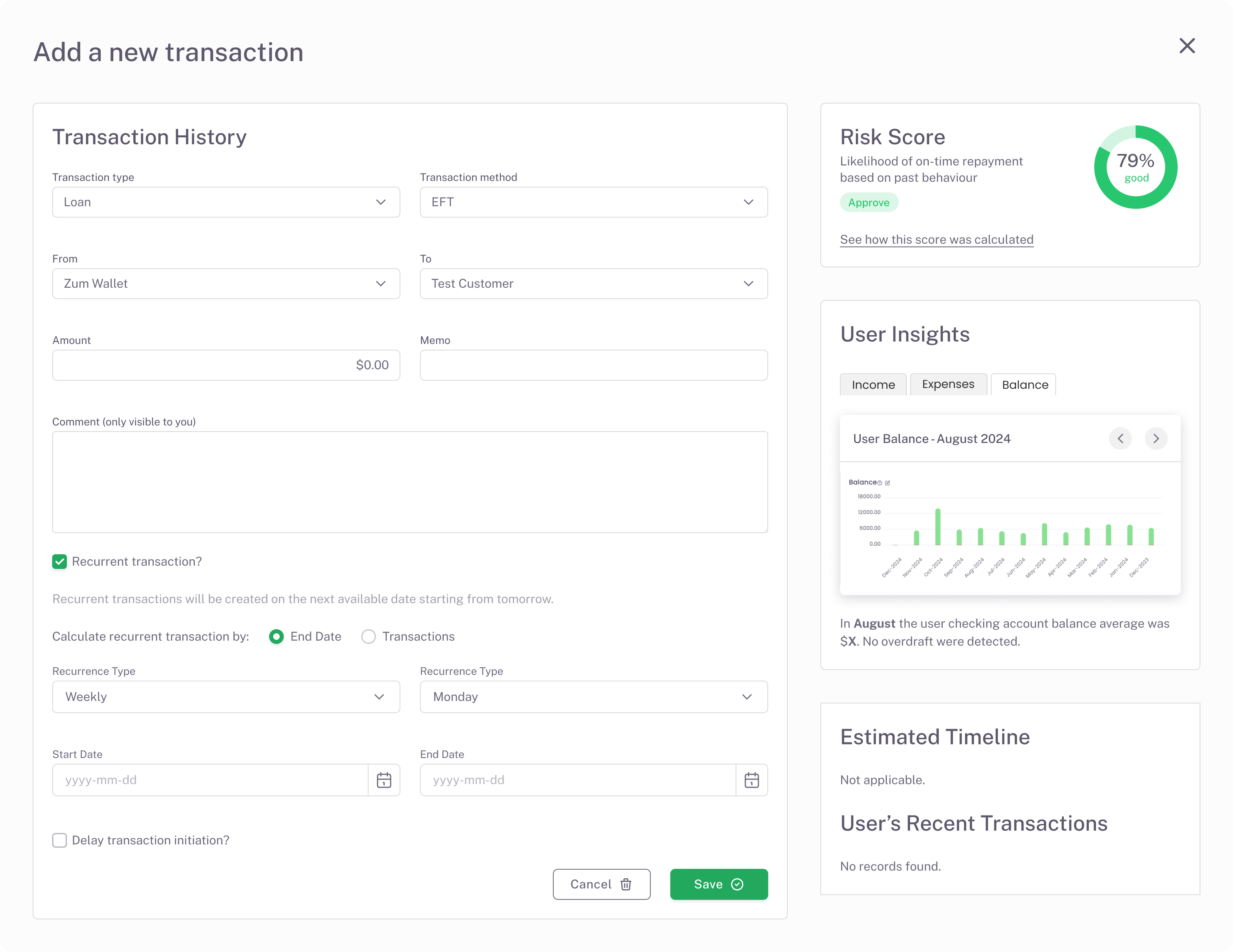

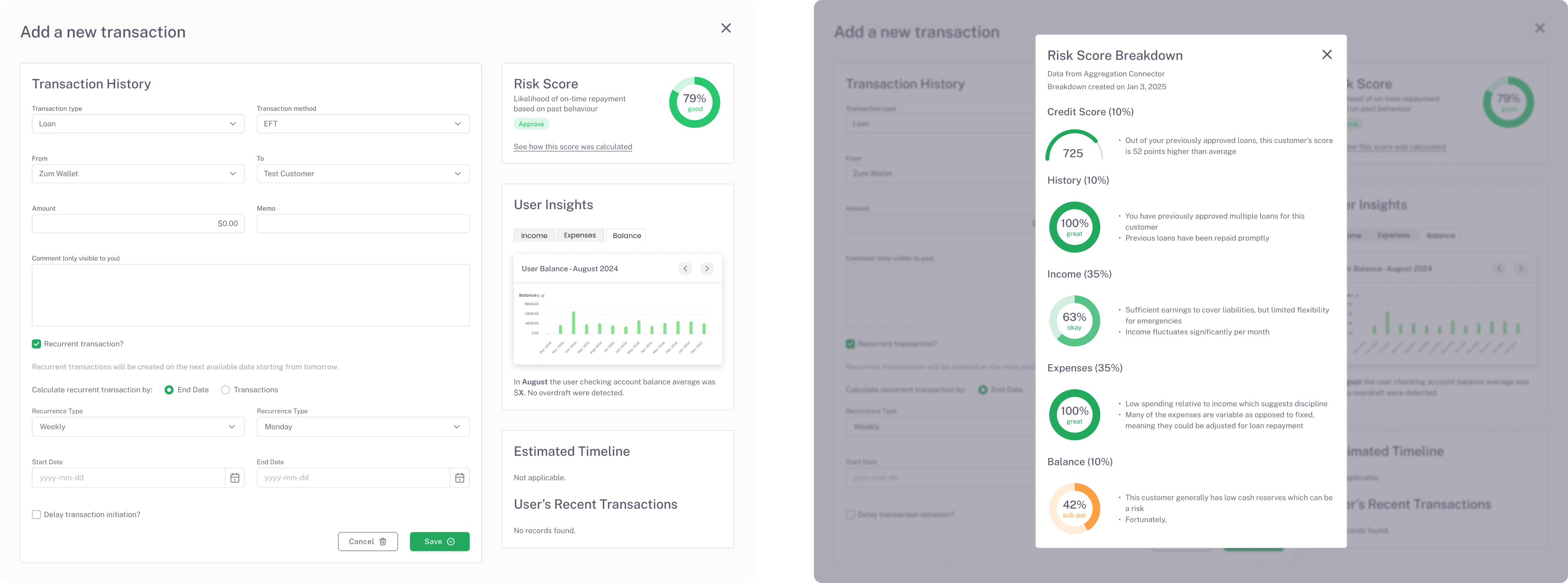

Creating a comprehensive indicator with trust

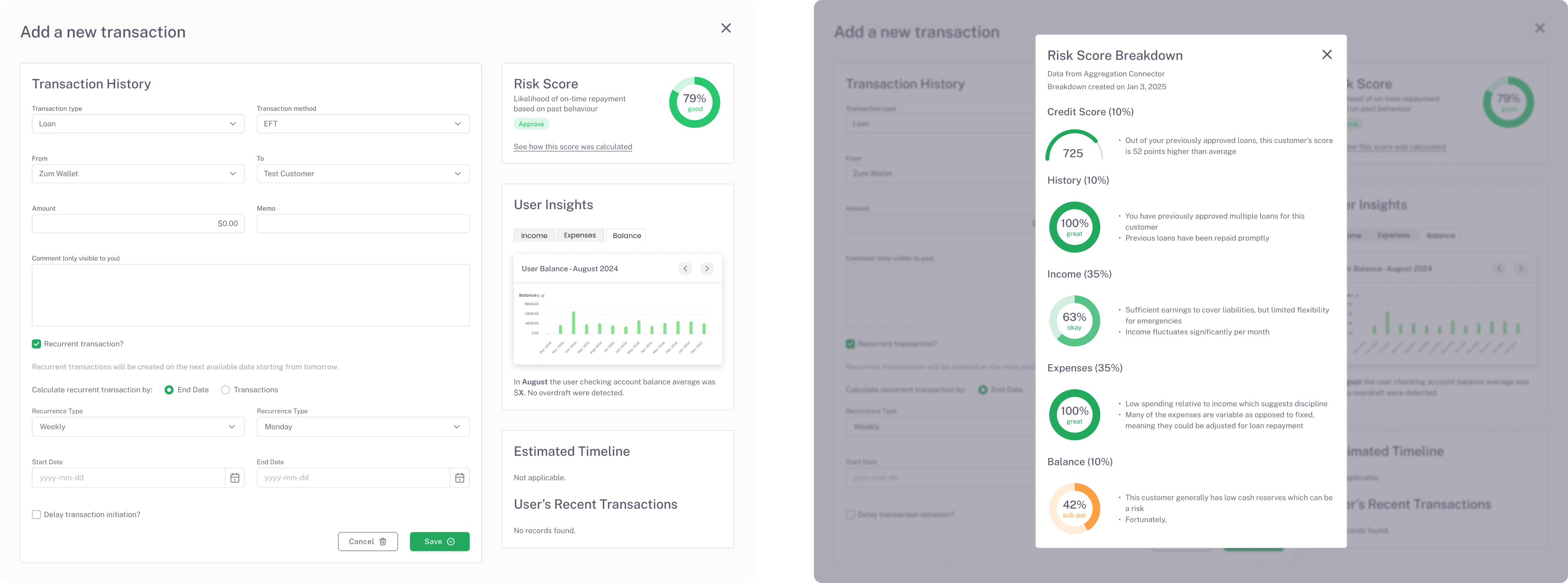

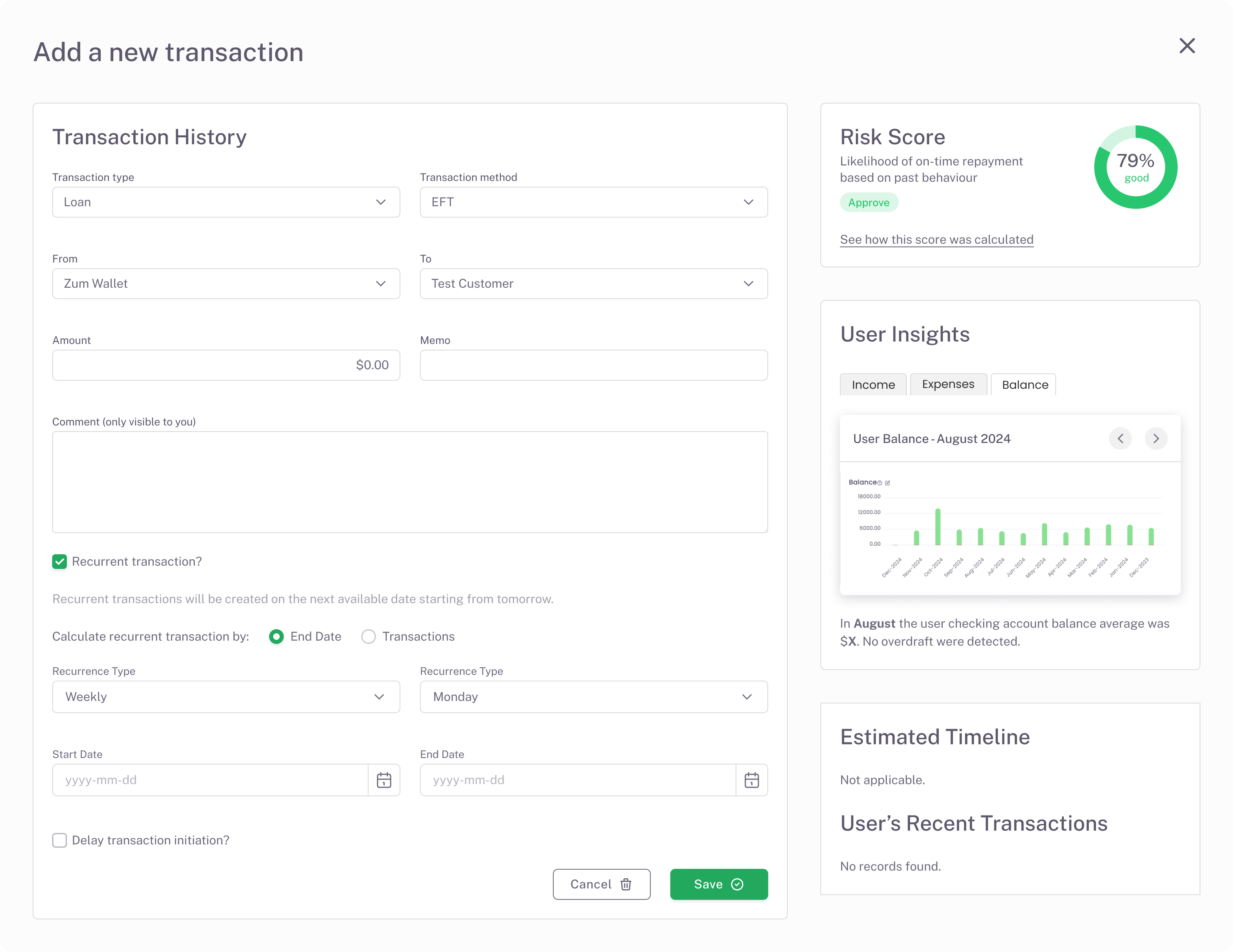

To reduce decision fatigue and improve speed, we introduced a new lending indicator that combined key financial signals: monthly balances, major expenses, and cash flow trends, into a single, trusted view. Rather than replace analysis, it gave users a confident starting point, streamlining their review process while still allowing for deeper dives when needed.

“

The risk score lending decision indicator has added real clarity to how we assess borrower applications. It's helped us move away from overly manual reviews and given the team a more consistent framework to work from. Since rolling it out, we've seen faster decision times and better alignment between risk tolerance and approvals. The biggest benefit is transparency: we can actually see what’s driving the score and decide if we agree with it.

Zum Rails

B2B Fintech — Enabling faster lending decisions for B2B customers

Striving for parity

Mapping major expenses, deposits, and account balances per month

Competitor tools were so valuable that customers used them for insights, then returned to us for payments. Rather than reinvent the wheel, we chose to start by matching these proven features. They offered clear, trusted value: highlighting key transactions and trends that directly supported faster lending decisions.

Faster lending decisions

Creating a comprehensive indicator with trust

To reduce decision fatigue and improve speed, we introduced a new lending indicator that combined key financial signals: monthly balances, major expenses, and cash flow trends, into a single, trusted view. Rather than replace analysis, it gave users a confident starting point, streamlining their review process while still allowing for deeper dives when needed.

“

The risk score lending decision indicator has added real clarity to how we assess borrower applications. It's helped us move away from overly manual reviews and given the team a more consistent framework to work from. Since rolling it out, we've seen faster decision times and better alignment between risk tolerance and approvals. The biggest benefit is transparency: we can actually see what’s driving the score and decide if we agree with it.

Zum Rails

B2B Fintech — Enabling faster lending decisions for B2B customers

When I joined Zum Rails, Data Insights was already a well-liked feature. It simplified B2C debit and credit data for B2B lenders, helping them make more informed decisions. In 2023, the company decided to monetize this feature. Initially, adoption was strong as most users converted to paid plans. However, by 2024, we saw a sharp increase in churn.

Problem

How might we create value, save time, and reduce effort required for B2B power users making lending decisions?

Outcome

43% increase in CSAT for Data Insights$1.2M projected ARR growth

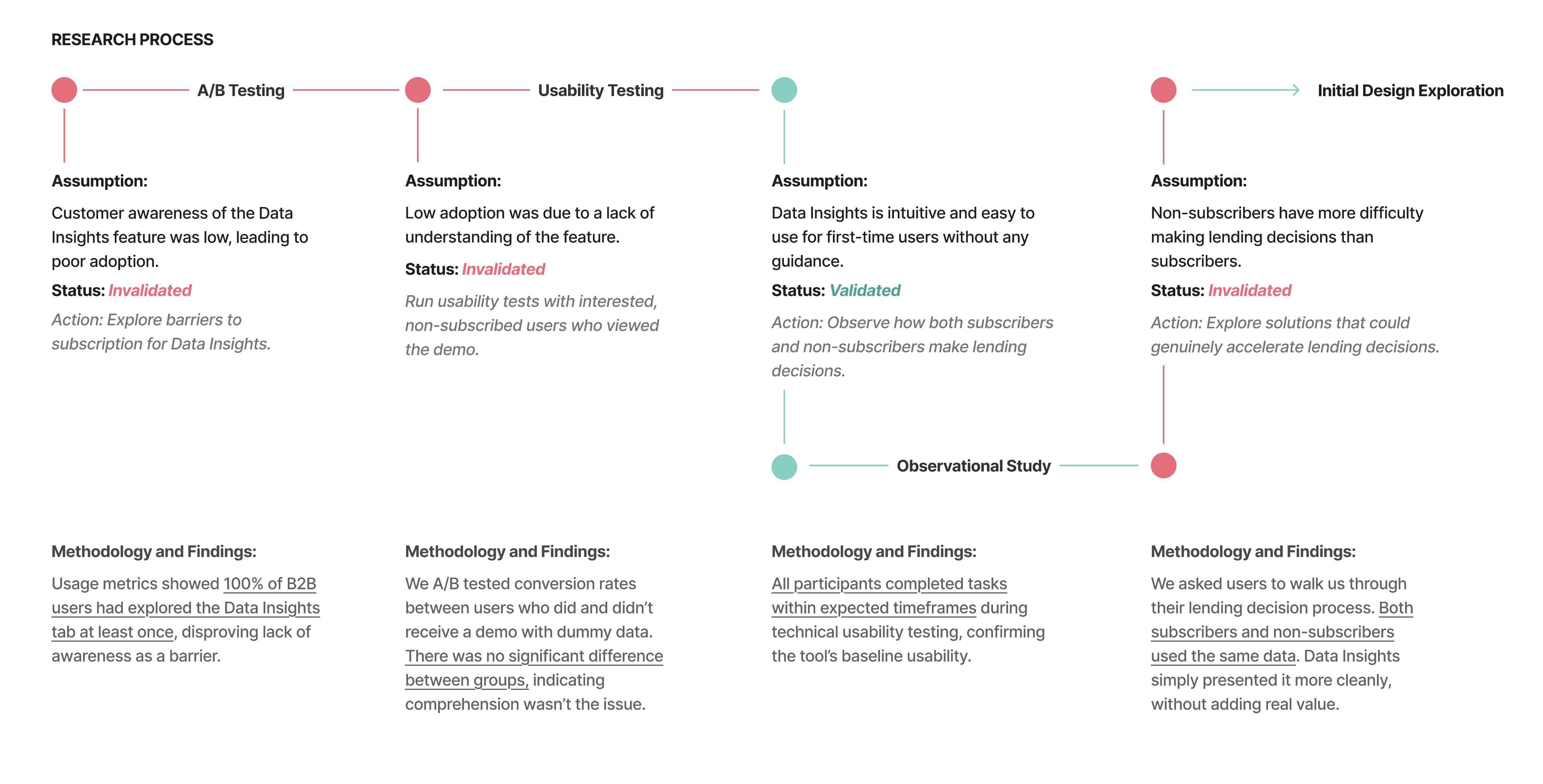

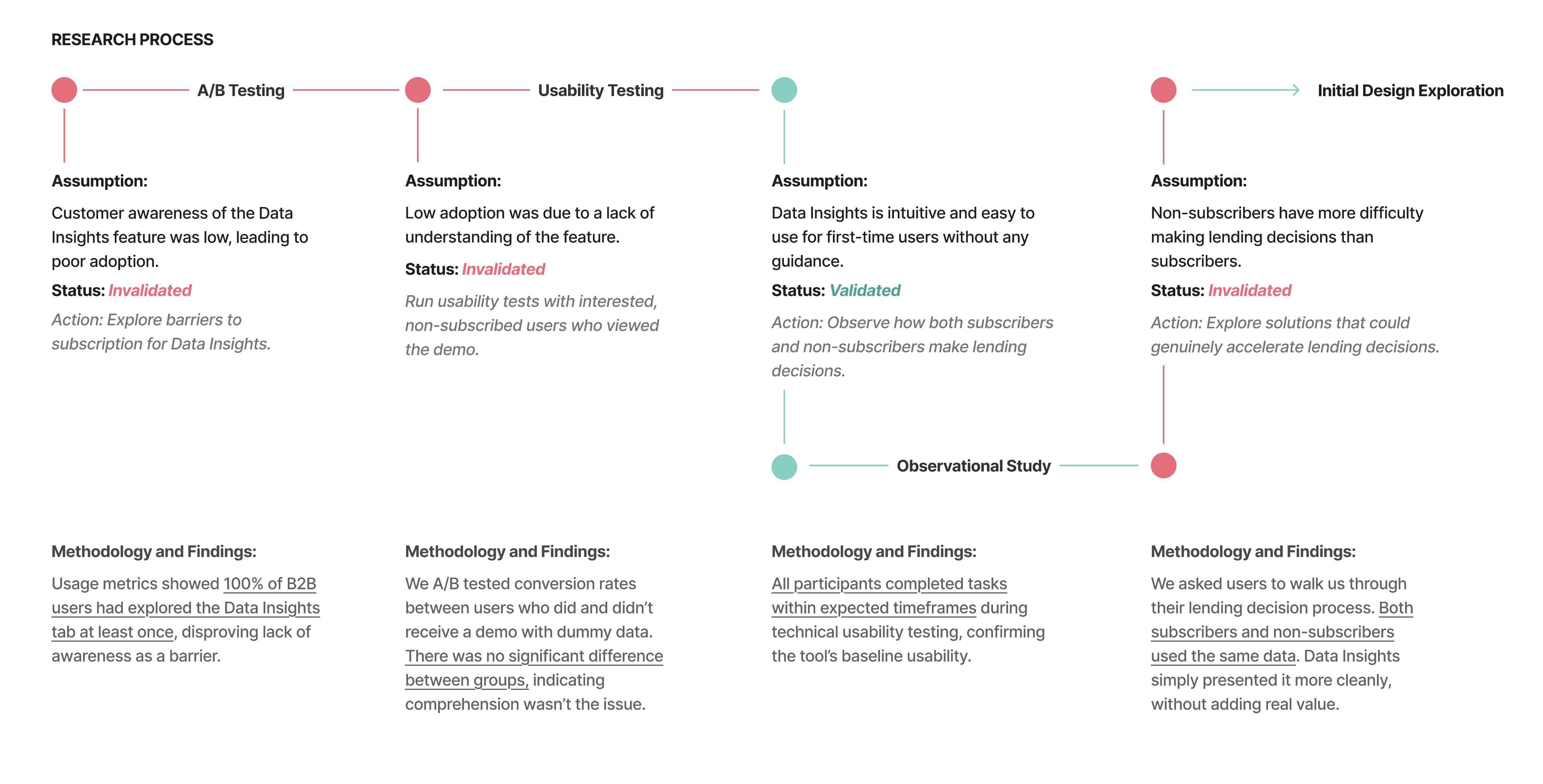

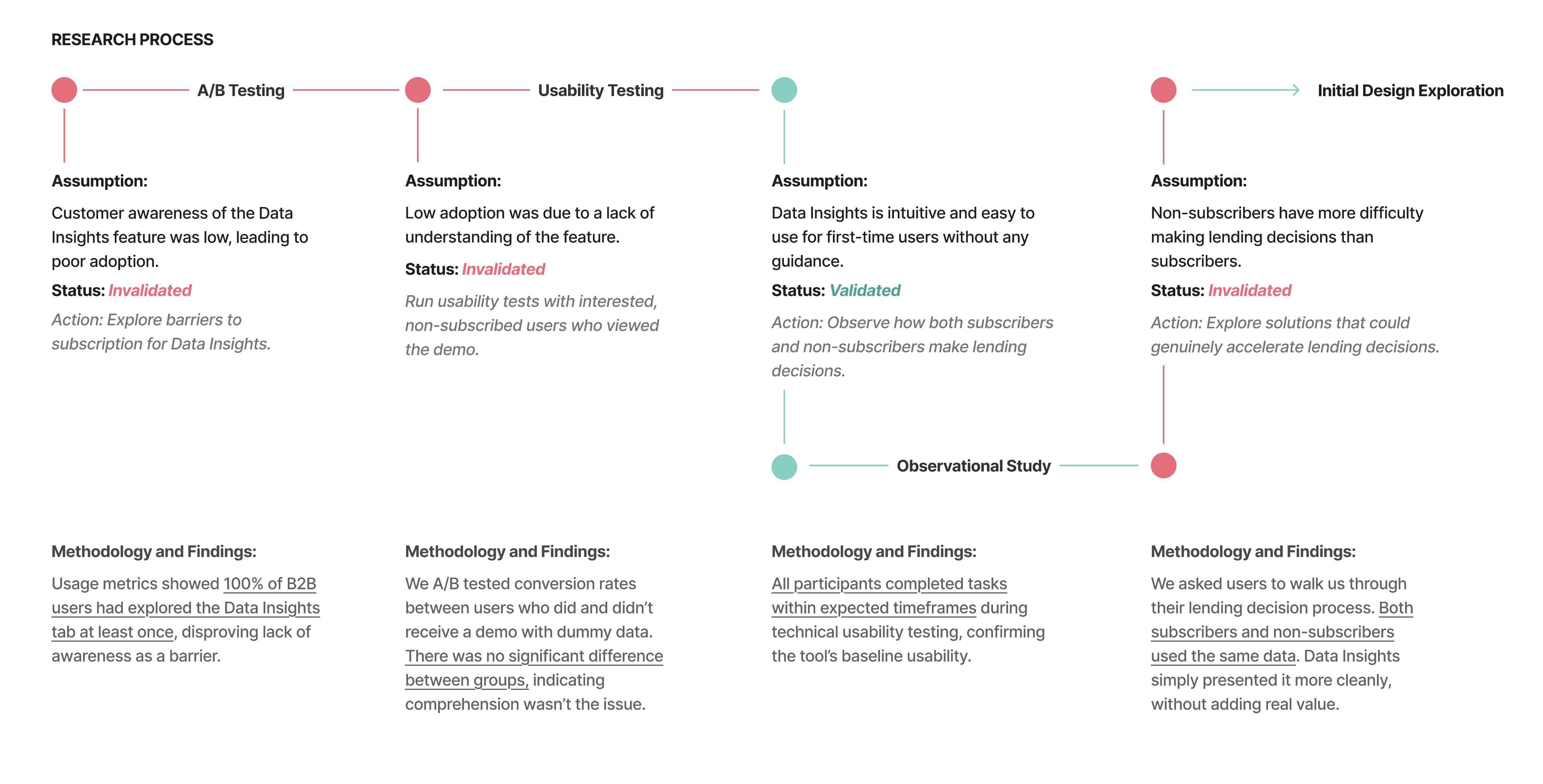

Assumptions testing

How we quickly validated our beliefs

We developed and tested our assumptions one at a time, using each result to inform the next. This iterative approach helped us quickly narrow in on the root causes of churn and identify which beliefs held up under scrutiny, and which didn’t.

01

Customers didn’t know the feature existed

Refuted by analytics.

02

The primary barrier to adoption is a lack of understanding for the feature

Refuted by demos and test data for non-subscribers.

03

Data Insights is intuitive for first time users

Confirmed through usability testing.

04

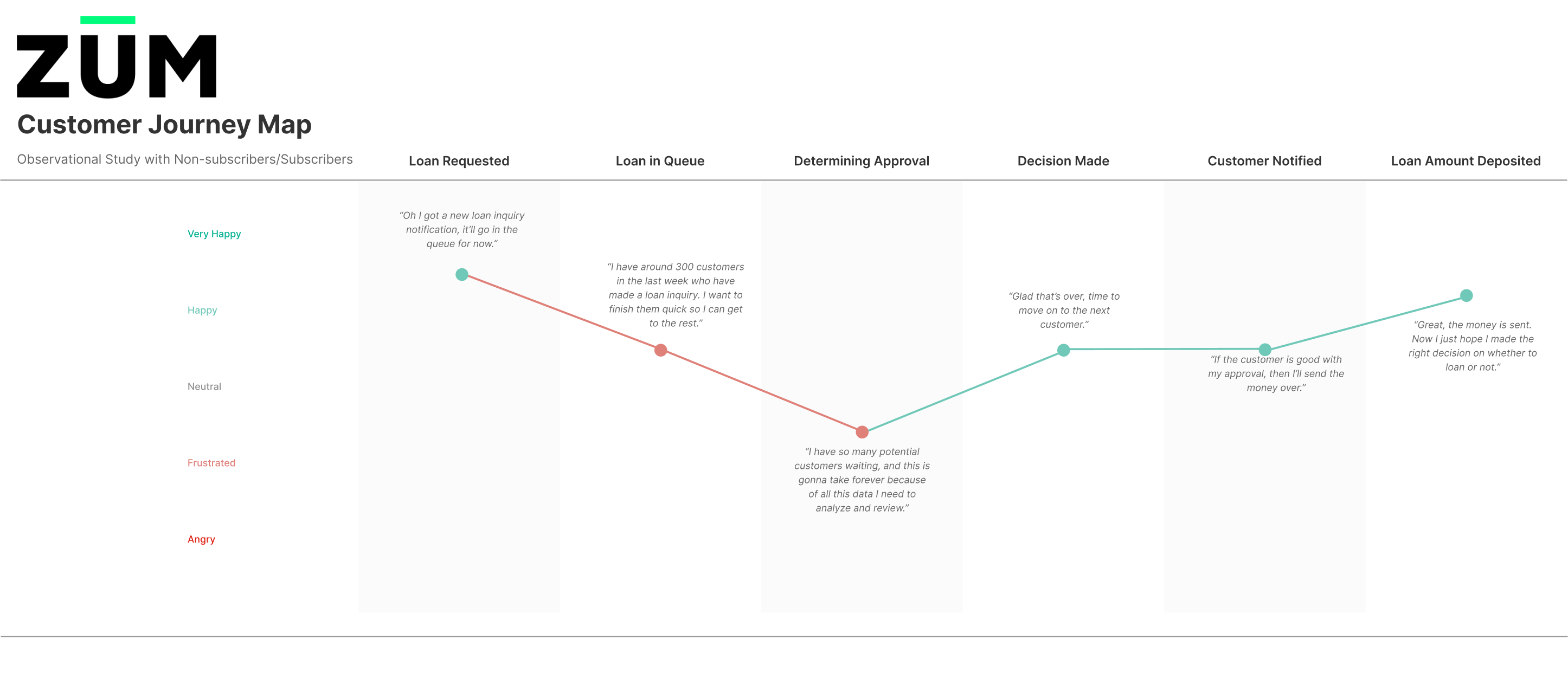

Non-subscribers have more difficulty making lending decisions than subscribers

Invalidated by observational studies.

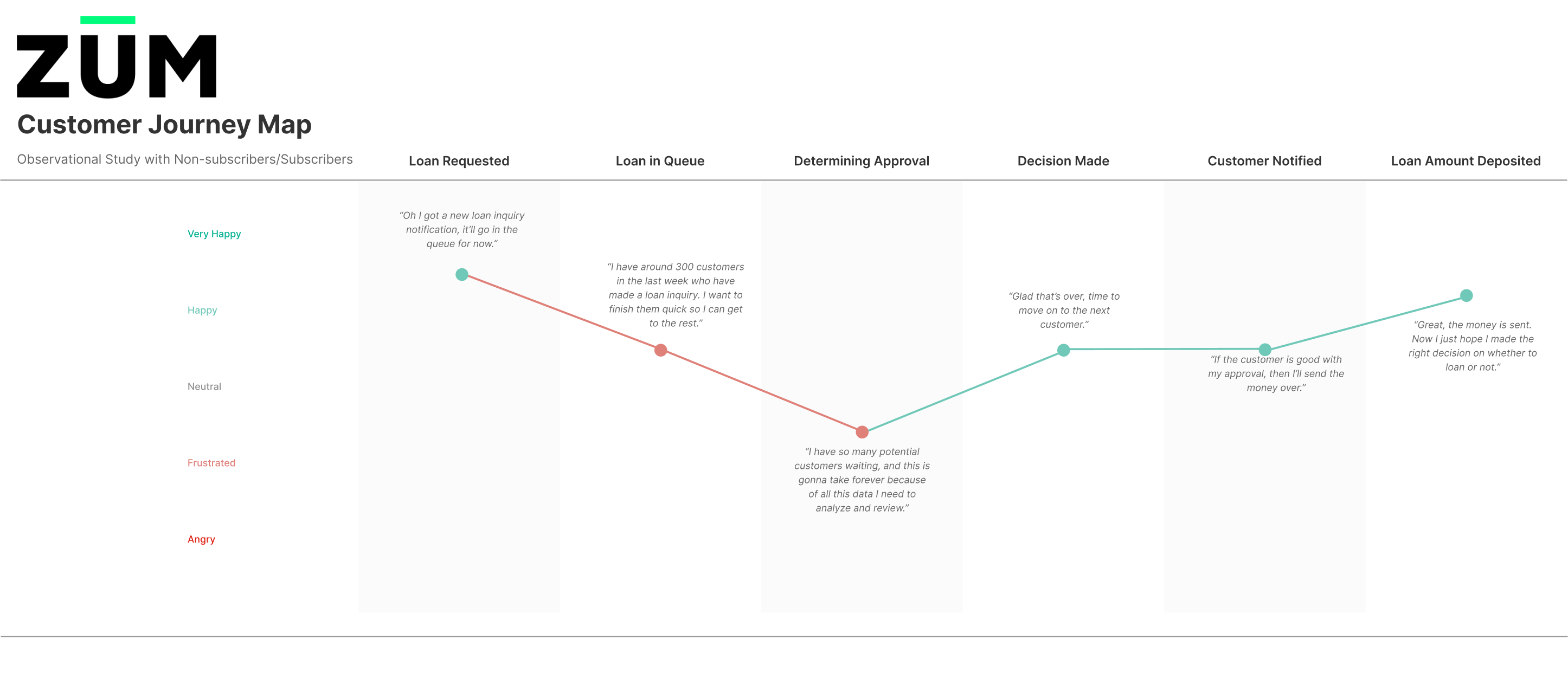

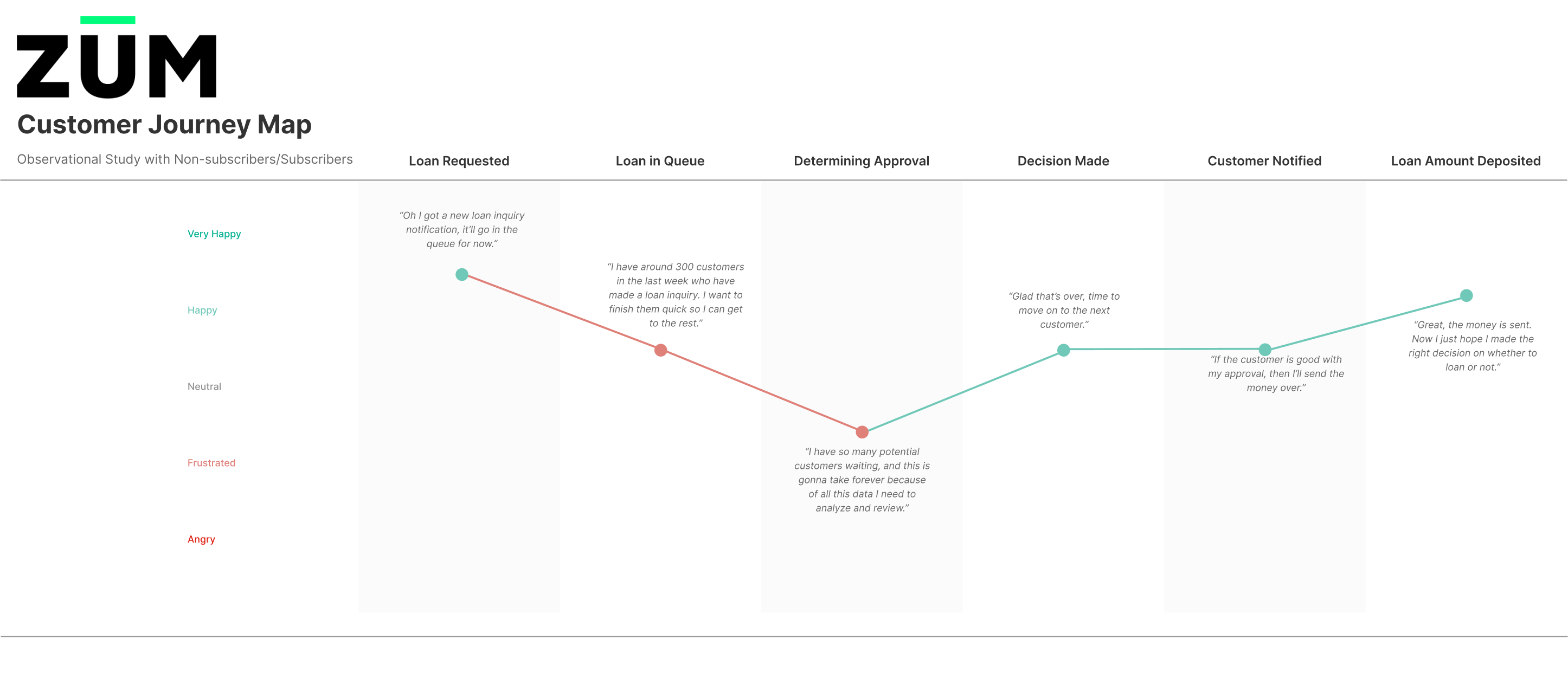

They didn’t need more data

They needed decision support

We followed up the observational study with in-depth user interviews to better understand what was missing. Here's what we found:

83%

of subscribers said Data Insights did not significantly improve lending decisions

The data shown in Data Insights mirrored what users already received through Aggregation, where B2C customers linked their bank accounts. Users still had to manually interpret the data themselves.

67%

of non-subscribers were paying another vendor for more actionable insights

We were losing users to more expensive alternatives that offered automated guidance, highlighting major deposits, expenses, and trends, making it easier to assess lending risk.

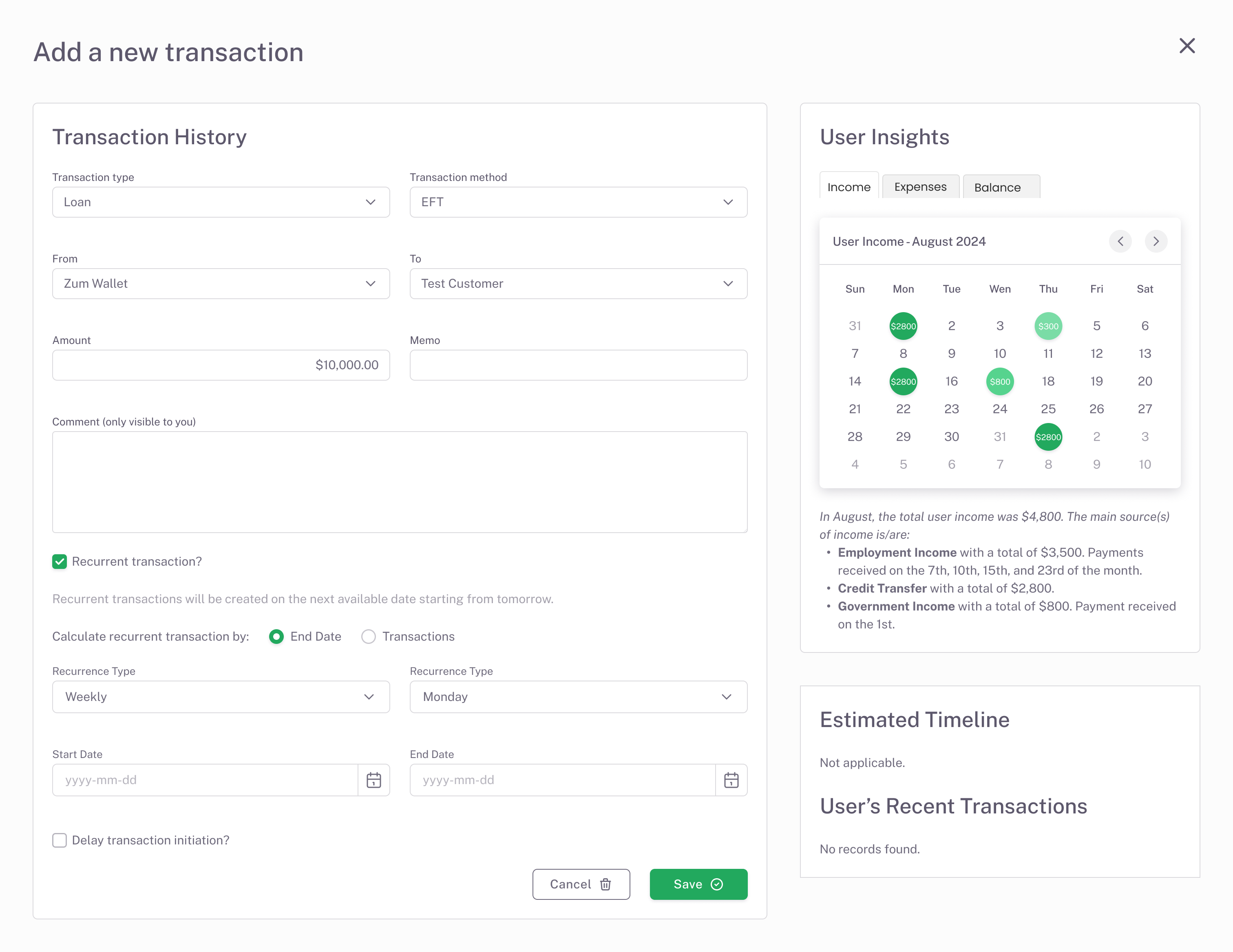

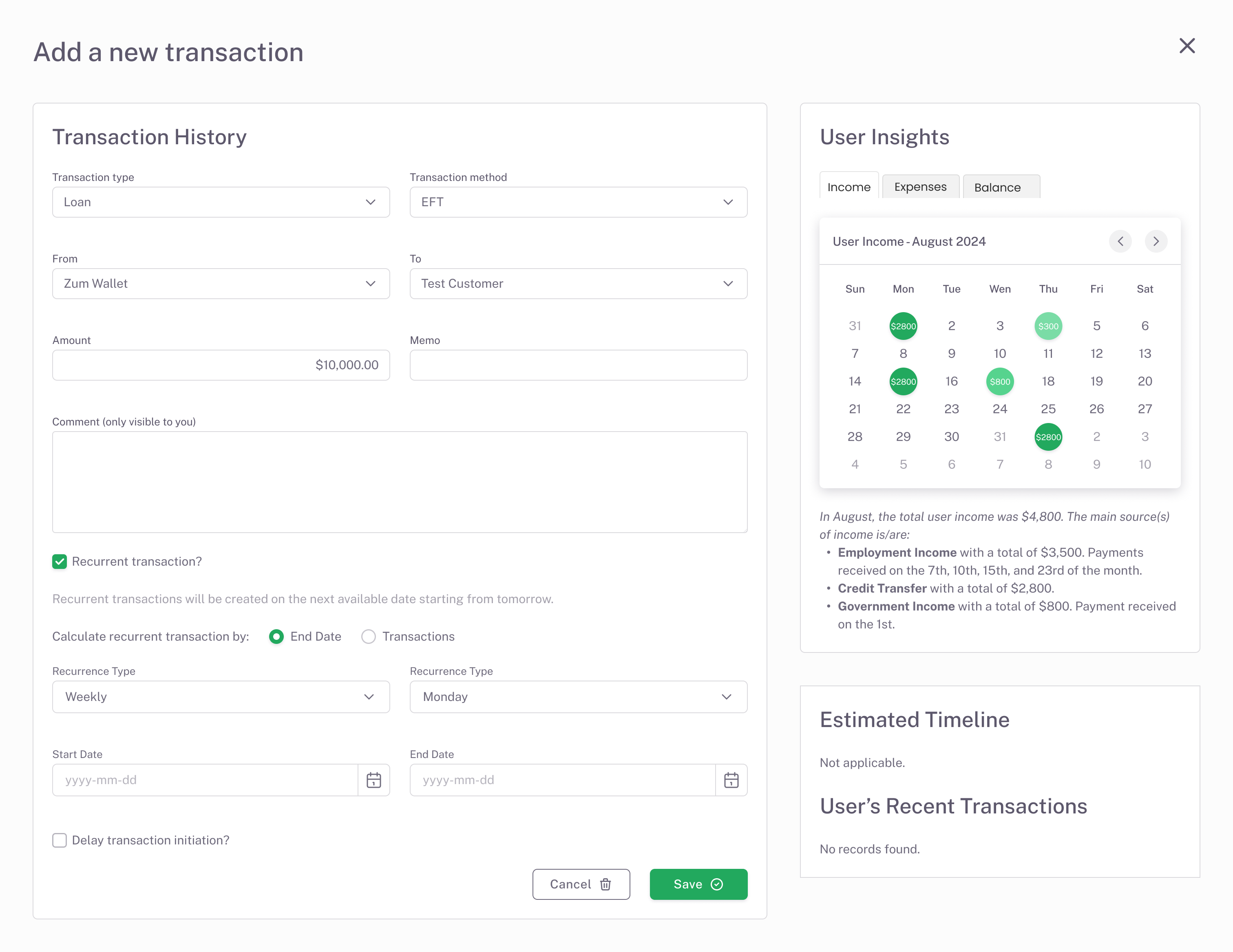

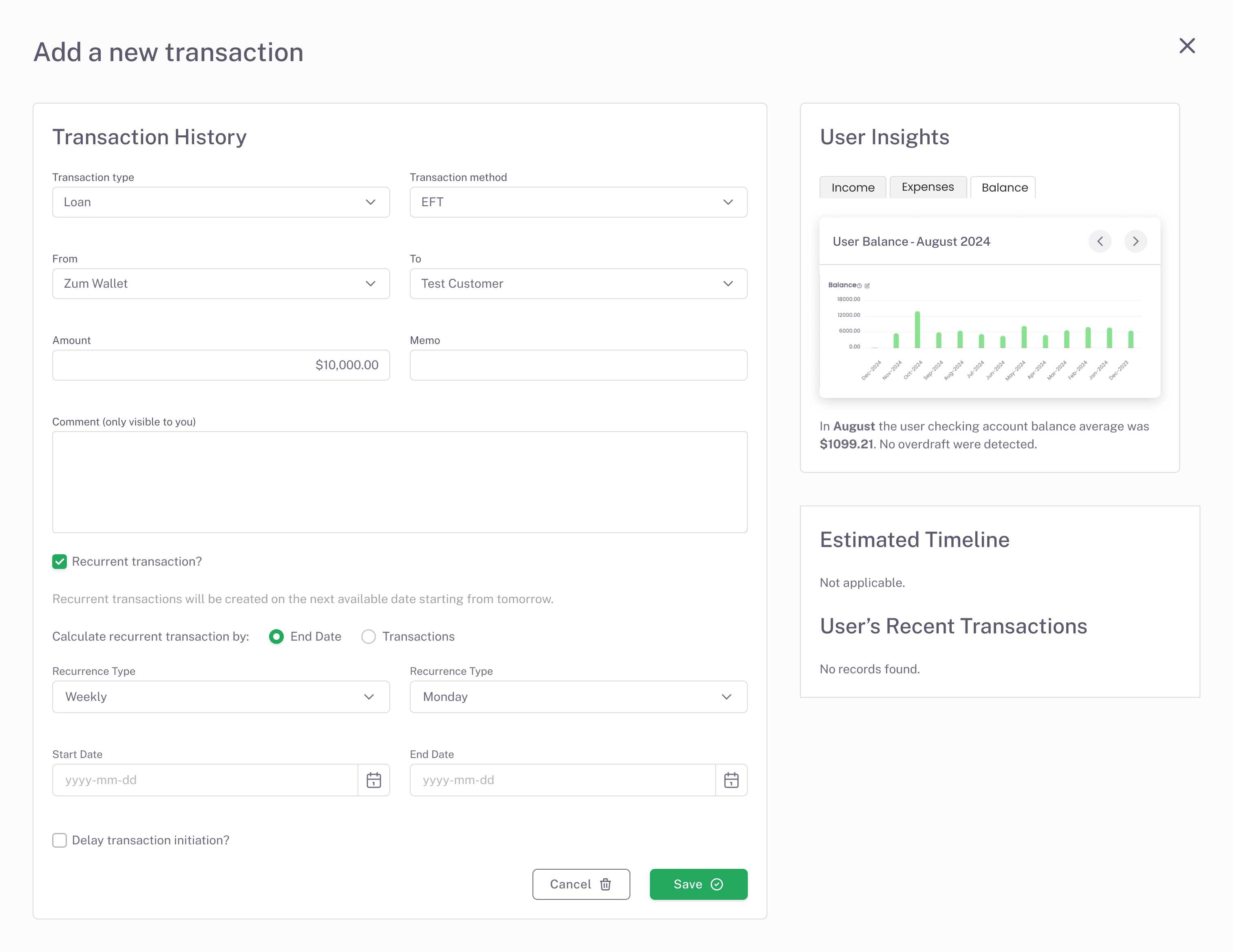

Striving for parity

Mapping major expenses, deposits, and account balances per month

Competitor tools were so valuable that customers used them for insights, then returned to us for payments. Rather than reinvent the wheel, we chose to start by matching these proven features. They offered clear, trusted value: highlighting key transactions and trends that directly supported faster lending decisions.

Faster lending decisions

Creating a comprehensive indicator with trust

To reduce decision fatigue and improve speed, we introduced a new lending indicator that combined key financial signals: monthly balances, major expenses, and cash flow trends, into a single, trusted view. Rather than replace analysis, it gave users a confident starting point, streamlining their review process while still allowing for deeper dives when needed.

The bottom line

The impact we delivered

In the same quarter we launched the new and improved Data Insights, we saw measurable results across both user satisfaction and revenue.

43%

increase in CSAT for Data Insights

Among surveyed subscribers, CSAT rose significantly, driven by the introduction of clearer risk scoring and automated mapping of income and expense patterns.

$1.2M

ARR growth

Based on early adoption trends and conversion rates, Data Insights is forecasted to drive $1.2M in new annual recurring revenue.

“

The risk score lending decision indicator has added real clarity to how we assess borrower applications. It's helped us move away from overly manual reviews and given the team a more consistent framework to work from. Since rolling it out, we've seen faster decision times and better alignment between risk tolerance and approvals. The biggest benefit is transparency: we can actually see what’s driving the score and decide if we agree with it.